General Systems, vol. 19, 1974, pp. 181-194

General Systems, vol. 19, 1974, pp. 181-194

Abstract

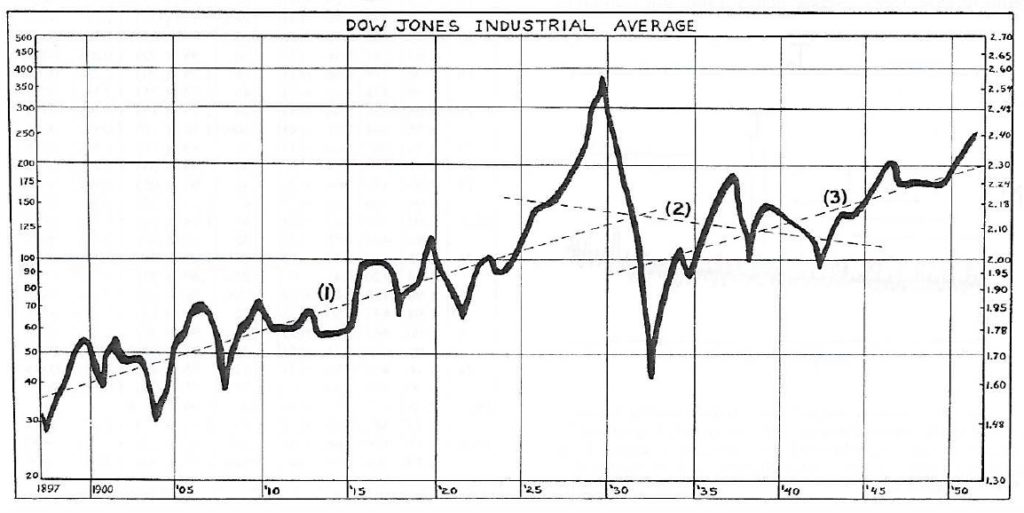

A method developed by E. Kerner for testing biological population fluctuations for predator-prey behavior is applied to the Dow Jones Average. The result shows that the stock market exhibited predator-prey behavior before and after the crash of 1929. The result shows that for about five years prior to the crash the market behaved as a hot market. This challenges claims by efficient market theorists that the market has always been efficiently priced. Hence it is shown that the practice of buying on the margin created a pricing bubble. In effect, it is shown that interacting markets by analogy behave in ahttps://www.hestories.info/the-non-local-mind.htmlfashion similar to interacting biological populations. The statistical mechanics which Kerner has developed for describing the behavior of interacting species is here applied to financial markets. General concepts such as “temperature”, “heat flow”, “internal energy”, “thermodynamic equilibrium” which Kerner uses in the description of interacting populations is here applied to interacting financial markets. The large amplitude pricing fluctuation which took place during the late 20’s is viewed as a period of high temperature. Following the crash stock market temperature fell as “heat” (capital) flowed into competing markets, such as the bond market and foreign capital markets, thereby temporarily increasing their temperature